PREPARING FOR GOOD TIMES

If you had a crystal ball with a high degree of certainty, what would you do now to take advantage of a forward-looking vision?

Following-up on my article titled “High Financing Costs Are Here For a While Longer”, published in 31 May 2024, there are now indications of improving conditions for business owners, CEO’s and CFO’s.

The question arises, what to do now to prepare for that eventuality? In other words, if you had a crystal ball with a high degree of certainty, what would you do now to take advantage of a forward-looking vision?

Graphs That May Serve As A Crystal Ball

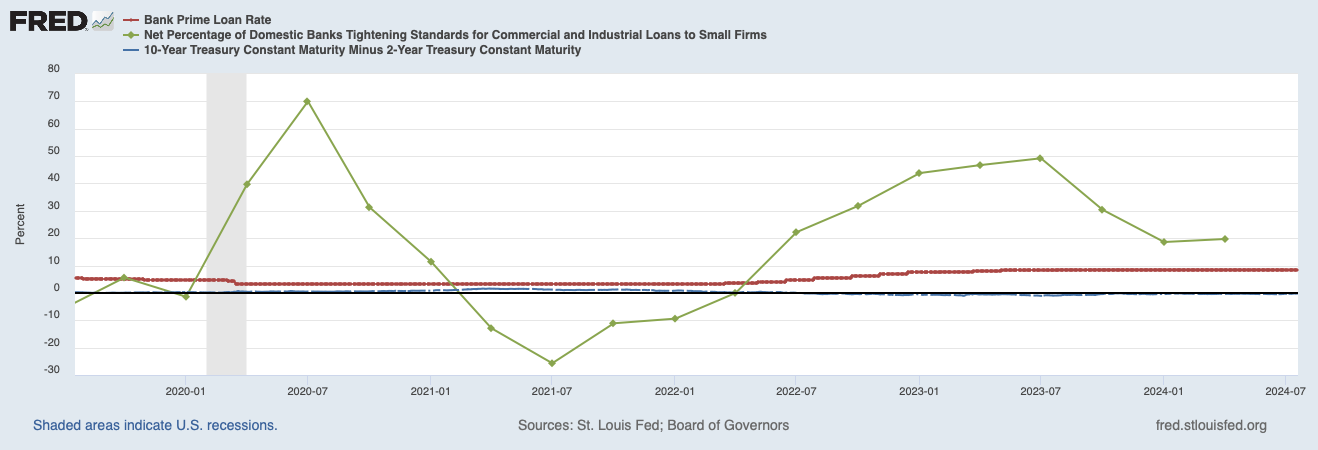

The first graph, stitched from Federal Reserve Bank of St. Louis data, points to the source of the constraints that has been directly felt in the daily relationship between business directors and funding sources.

Since early-2022, in response to inflation, we have had a double whammy, involving two adverse events that have joined to make the business environment less favorable: a rise in the Bank Prime Loan Rate (red) and a rise in Bank Loan Tightening Standards (green). In brief, the cost of capital became higher, while the constraints on borrowers became tighter.

The 2023-2024 period contrasts markedly to the two years between 2021 and 2022 where rates were low and standards were loose. The pain is felt worse because we have a fresh memory of the good times.

It is possible to see in the graph that there has been a lowering in the bank tightening standards as inflation is pushed down.

The Possible Good News

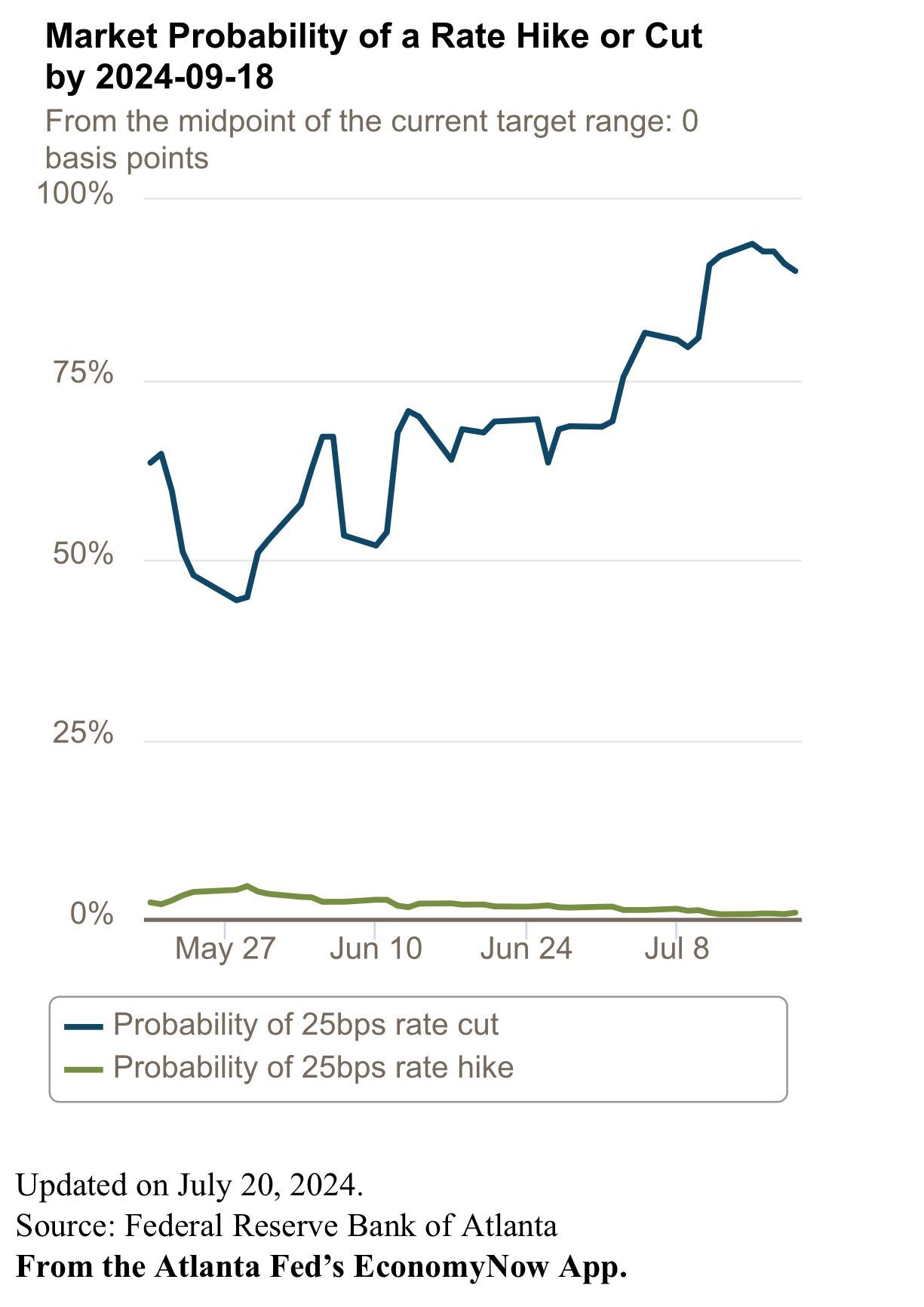

The second graph, from the Federal Reserve Bank of Atlanta, points to a high probability that the Federal Open Market Committee (FOMC) will cut interest rates by September 18, further improving conditions.

Together these charts indicate that both rates and standards are moving in a direction that is favorable to business owners, CEO’s, CFO’s, and lenders, who will be able to write new business or increase lines of credit.

Two Additional Indicators

Although hard to see in the first chart, 10-year treasury rates are not raising, even when compared to Moody's Seasoned Aaa Corporate Bond yields. This indicates that large companies, that can, are not running towards bonds as an alternative to corporate loans for capital raises.

Then there is the article by David McCann at CFO.com, who references David Dean, managing director of mergers and acquisitions for WTW, indicating that “financial trends and increasing deal activity suggest a potential return to pre-Covid acquisition levels.”

But How To Prepare?

With this view, I do suggest that now could be a good moment for company owners, CEO’s and CFO’s to start redefining their relationship with their funding source.

Seeing this change coming, now can be a good opportunity to not only lower costs (not just interest rates but also fees), but to also aim at increasing the company’s strategic competitiveness and agility by bringing back those growth plans that were put on hold during the tight conditions.

Why It Is Imperative To Be Done Now?

Historically we have learned that it takes at least two months to find, select a new funding source and go through the approval process until funding. This involves a method for right-matching with a strategic funding partner, not just finding a lender (for example, merchant cash advance operations will have you locked into onerous capital at a blink of an eye).

That process has to be in step with the calendar year. You should not start the process in November with the hopes of having funds in the same year because it is unlikely that a good funding sources will have the appropriate time for the process and likely it will fall into the next calendar year.

If the interest rate drops in mid-September, many companies will then wake-up and start rate hunting, flooding lenders with inquiries and paperwork. If your company starts looking after the rate drop, if not well prepared, likely it will not get funded this year. Those that will get funded will have a competitive advantage in executing their strategies ahead of those that don’t act now.

Time And Focus: The Usual Problems For Business Owners, CEO's and CFO's

Despite obvious pains, costs and limitations, business owners stick with their current lending relationship, missing out on opportunities, because of the friction involved in finding a new strategic funding relationship:

a) It can be a disruption away from their core business;

b) they have been with the lender for X years and it is easier to go along with whats at hand than to start looking afresh;

c) And how do you find someone? Offers of capital arrive every day, but which to choose without making a mistake?

Outsource Now The Search For A Strategic Funding Relationship

CORNER has historically helped drive business growth for our clients by accurately matching them with strategically-beneficial financial services that fit their needs.

We leverage a network of established firms that are searching for companies with a track-record of growth and good leadership with the aim to build mutually beneficial relationships for financial growth.

CORER’s methodology helps avoid many of the pitfalls of searching, while connecting to capital sources that understand business, markets and clients, resulting in the business owner, CEO and CFO having full control over their financial objectives and over your financial relationship at the right time.

Visit our website to learn more: www.CORNERfinance.com Likely we can help your company take advantage of the improving conditions. If you are interested we can have a brief call to trade ideas.